Embark on the journey of finding the most reliable car insurance providers with Shop Car Insurance Quotes to Find the Most Reliable Providers. This guide will walk you through the essential steps and factors to consider in your search for the best coverage.

Delve into the world of car insurance as we explore the importance of shopping around, factors to consider, researching reliable providers, and tips for making an informed decision.

Importance of Shopping Car Insurance Quotes

When it comes to purchasing car insurance, shopping around for quotes is a crucial step that should not be overlooked. By exploring various options and comparing quotes from different providers, you can ensure that you are getting the best coverage at the most competitive rates.

Identifying the Benefits of Comparing Quotes

- Allows you to find the most affordable rates: By obtaining quotes from multiple insurance companies, you can compare prices and choose a policy that fits within your budget.

- Helps you understand coverage options: Comparing quotes gives you the opportunity to review different coverage options and select the one that best meets your needs.

- Gives you bargaining power: Armed with quotes from various providers, you can negotiate with your preferred insurer for better rates or additional discounts.

How Shopping for Car Insurance Can Help Find Reliable Coverage

Shopping for car insurance not only helps you save money but also ensures that you are getting reliable coverage. By comparing quotes, you can evaluate the reputation and customer service of different insurance companies, ultimately choosing a provider that offers trustworthy and dependable coverage.

Factors to Consider When Shopping for Car Insurance

When shopping for car insurance, it is essential to consider various factors to ensure you get the coverage that meets your needs at a reasonable price.

Coverage Options

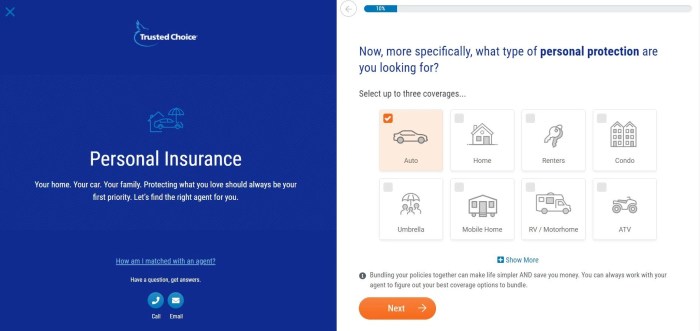

- Review the different coverage options offered by insurance providers, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Consider your individual needs and the level of protection you require based on factors like your vehicle's value, driving habits, and budget.

- Choose coverage limits and deductibles that align with your financial situation and provide adequate protection in case of an accident.

Impact of Coverage Type on Provider Choice

- Providers may specialize in specific types of coverage, so the type of coverage you need can influence the choice of insurance companies.

- For example, if you require comprehensive coverage for a high-value vehicle, you may prioritize providers known for offering comprehensive policies with excellent customer service.

- Consider whether the provider has a good track record of handling claims related to the type of coverage you need.

Reputation of Insurance Companies

- Research the reputation and financial stability of insurance companies before making a decision.

- Look for reviews, ratings, and customer feedback to gauge the quality of service provided by different insurers.

- Choose a reputable insurance company with a history of prompt claims processing and customer satisfaction to ensure a smooth experience in case of an accident.

Researching Reliable Car Insurance Providers

When it comes to finding a reliable car insurance provider, thorough research is key. By comparing customer reviews, ratings, and evaluating various factors, you can make an informed decision. Here are the steps involved in researching reputable car insurance providers:

Compare Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the experiences of policyholders with different insurance companies. Look for trends in feedback regarding customer service, claims processing, and overall satisfaction. Consider websites like J.D. Power, Consumer Reports, and the National Association of Insurance Commissioners for comprehensive reviews.

Design a Checklist for Evaluating Reliability

Create a checklist to evaluate the reliability of insurance providers based on specific criteria. Consider factors such as financial stability, customer service reputation, coverage options, claims process efficiency, and discounts offered. Use this checklist to compare different insurance companies and narrow down your options.

Research Company Reputation

Research the reputation of insurance companies by checking their financial strength ratings from agencies like A.M

Additionally, look for any complaints filed against the company with state insurance departments or consumer protection agencies.

Seek Recommendations from Trusted Sources

Ask for recommendations from friends, family, or colleagues who have had positive experiences with their car insurance providers. Personal referrals can provide valuable insights and help you identify trustworthy companies. Consider reaching out to insurance agents or brokers for expert advice on finding a reliable provider.

Tips for Finding the Most Reliable Car Insurance Providers

When searching for car insurance, it is crucial to find a reliable provider that offers the coverage you need at a fair price. Here are some tips to help you find trustworthy car insurance providers:

Verify the Financial Stability of Insurance Companies

Before choosing an insurance provider, it is essential to verify their financial stability. A financially stable company will be able to fulfill their obligations to policyholders, especially in the event of a claim. Here's how you can check the financial stability of an insurance company:

- Look for ratings from independent agencies such as A.M. Best, Standard & Poor's, or Moody's.

- Review the company's financial statements and annual reports to assess their profitability and solvency.

- Check if the insurance company is a member of state guarantee funds, which provide protection in case the insurer becomes insolvent.

Leverage Independent Ratings and Reviews

Independent ratings and reviews can provide valuable insights into the customer service, claims process, and overall satisfaction with an insurance provider. Here's how you can leverage independent ratings and reviews when choosing a car insurance company:

- Check websites like J.D. Power, Consumer Reports, and Insure.com for customer satisfaction ratings.

- Read customer reviews on platforms like Trustpilot or BBB to gauge the experiences of other policyholders.

- Consider seeking recommendations from friends, family, or colleagues who have had positive experiences with their car insurance provider.

Last Point

In conclusion, finding the most reliable car insurance providers is crucial for your peace of mind on the road. By comparing quotes, researching reputable companies, and following our tips, you can secure the coverage you need with confidence.

FAQ Summary

Why is shopping for car insurance quotes important?

Shopping around allows you to compare prices, coverage options, and find the most reliable providers that meet your needs.

What factors should I consider when shopping for car insurance?

Key factors include coverage options, deductibles, premiums, and the reputation of insurance companies.

How can I research reliable car insurance providers?

Research reputable providers by comparing customer reviews, ratings, and creating a checklist to evaluate their reliability.

Any tips for finding the most reliable car insurance providers?

Verify the financial stability of companies, leverage independent ratings, and reviews to make an informed decision.